Being an expert resource for your clients is more important now than ever before.

Set yourself apart.

Single-Family Home

Whether it’s qualifying for a larger home or seeking the most financially prudent purchase method, our system will provide you with clear guidance and unparalleled tools.

Our programs allow for larger preapprovals, more overall asset liquidity, greater tax efficiency and increased chances for long-term wealth building. Partnering with ALQYMI allows you to help your clients accomplish their goals.

We complete detailed analysis of each client’s unique circumstance, educate them about their options with clear, individualized reports and work with you through the underwriting and home purchase process.

Multiple Units & Investment Properties

Clients wanting to incorporate investment properties into their portfolio can now get clear guidance on the best way to do so. Whether using our SmartMortgage program to afford more units, or our Wealth Builder program to maximize their overall net worth, while incorporating real estate, use our proprietary solutions to give them the tools and edge they need.

Our Comparative Property Screener is another first-of-its-kind tool to quickly and thoroughly break down the benefits and drawbacks of one or more properties for consideration and will be live and available to ALQYMI partners in the second quarter of 2021.

Remodel & Rehab

For clients who are interested in taking on projects, the ALQYMI programs break down available options, creating clear and understandable options. Whether seeking a loan and needing a little boost to qualify for those dream updates, or comparing loan options and rates, we are here to help you through it.

As with home purchases, maintaining liquidity, maximizing tax efficiency and getting the best rates can have a huge effect on a client’s long-term success and wealth down the road.

Reach for the stars with our Maximum Leverage

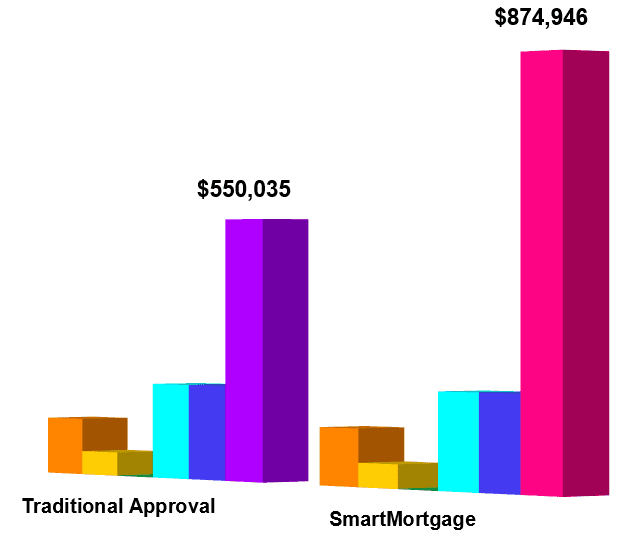

Traditionally our system has been used for clients who either need a little assistance to get qualified for their desired home or clients who are mindful of their long-term wealth goals and are in need of our unique expertise.

ALQYMI is now offering the ability for you to show your clients their MAXIMUM potential approval.

While this is an incredibly powerful tool, sometimes allowing clients to purchase properties well outside the norm, please keep in mind that we are fiduciaries and will always act in the best interest of our clients.

Increase Prequalifications

Afford more home

Succeed in competitive markets

Streamline underwriting

Maintain liquidity

Decrease taxes

Maximize deductions