Maximize net worth • Grow real estate holdings

Maintain tax deductions • Reduce liabilities • Increase liquidity.

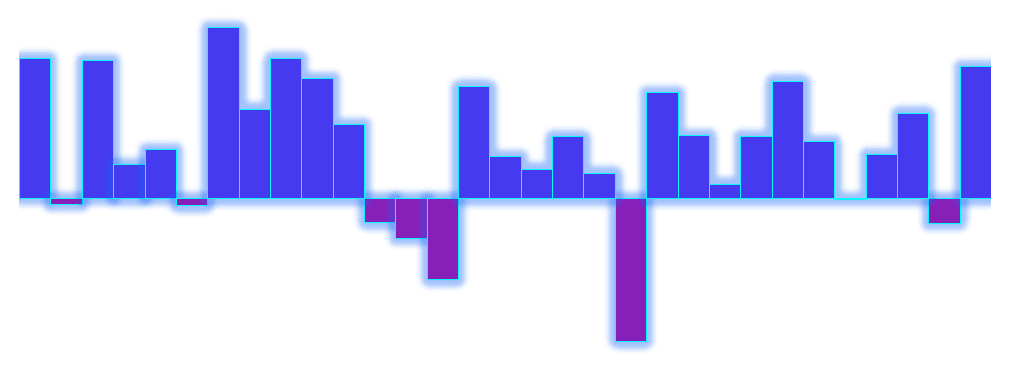

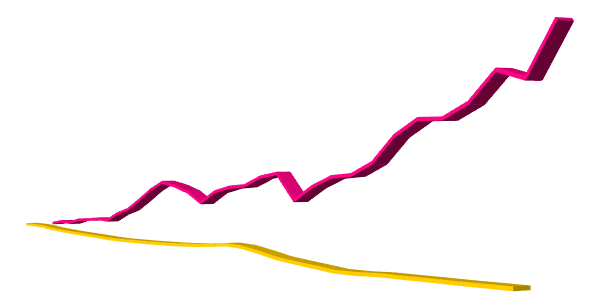

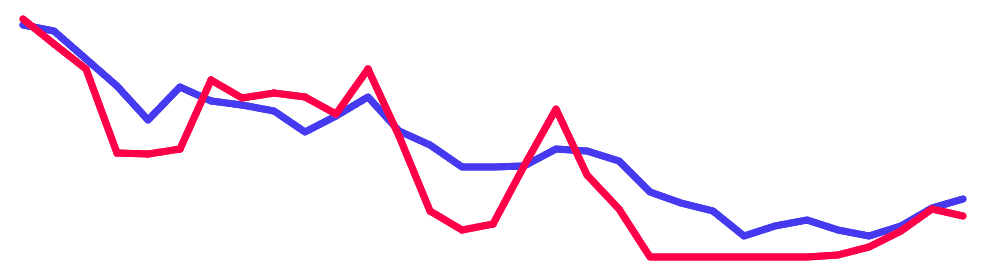

Evaluate decades of market returns for different investment blends.

Explore multiple portfolio options based on individual risk tolerance and goals.

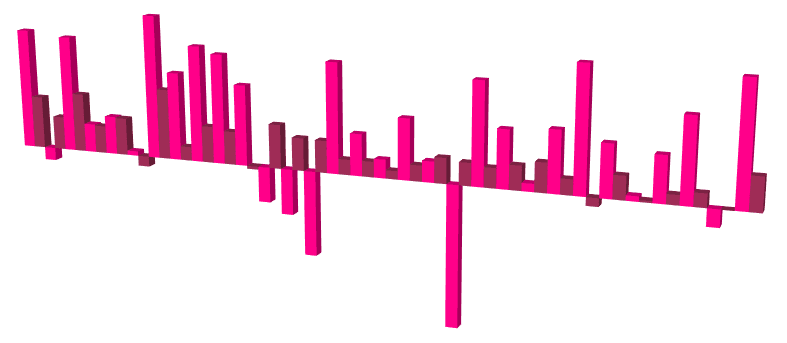

Compare and contrast dozens of real estate markets over 30 years and see how those returns correlate to portfolios.

Examine rates of return, trends, market correlation and other key statistics to help make crucial decisions about how and where to purchase.

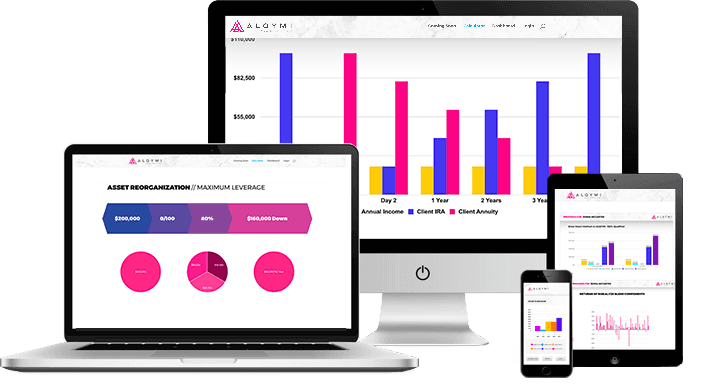

Review your finance and lending options for various investments, property types and terms.

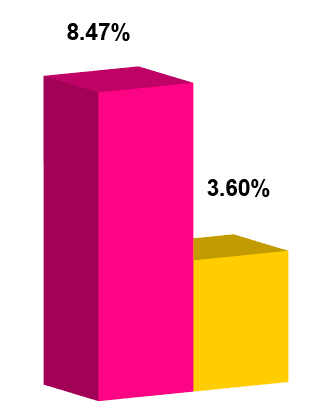

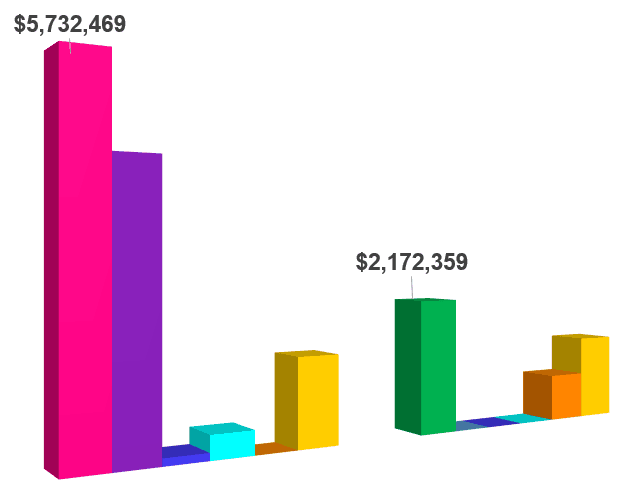

Get detailed visual analysis and a breakdown of your various options and their potential impact on future net worth, liquidity and tax efficiency.

Increase Real Estate Purchasing Power

Use our proprietary methods to evaluate, reorganize and manage client assets in ways that maximize mortgage approval and increase underwriting confidence.

Enhance Client Long-term Wealth Building

Examine investments, including real estate, and apply our program to the way clients purchase and hold these assets, increasing the chance for long-term wealth building.

Maximize Tax Benefits and Reduce Liabilities

Maintain deductions while allowing for the utilization of client assets without investment liquidation, encouraging continued growth while avoiding taxable events.

Protect Client Assets By Diversifying Risk

Utilize measured amounts of leverage, stable long-term financing and insurance to cover assets, allowing clients to grow net worth while protecting wealth.