A revolution in real estate, the ALQYMI SmartMortgage system evaluates and optimizes client assets to greatly increase buying power, tax efficiency, liquidity and risk mitigation, all while maintaining a fiduciary approach to long-term wealth building.

ALQYMI conducts a detailed review of your portfolio, financials, insurances, goals and risk tolerance. We then make recommendations and reorganize assets to better align with client goals and risk.

Every client is unique, and so is their portfolio. Once we have reviewed the client’s goals and risk, and optimized the client’s portfolio, we can look at the historical performance data and assess how their real estate goals compare and contrast. We run a full report with our software that dissects these two important segments of net worth.

Once we are comfortable with the investment blend and real estate goals, our proprietary program breaks down the client’s financials and investments and produces additional resources that could be used for the purchase of real estate and mortgage underwriting.

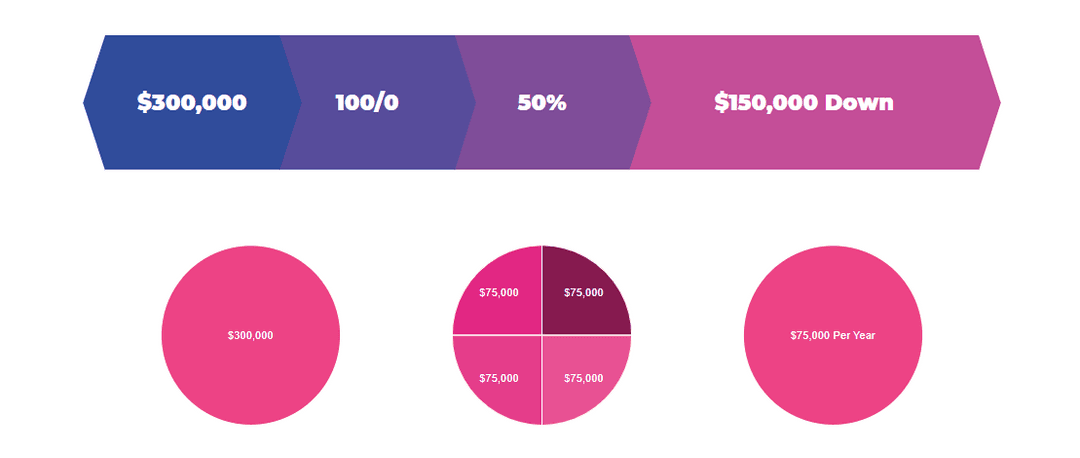

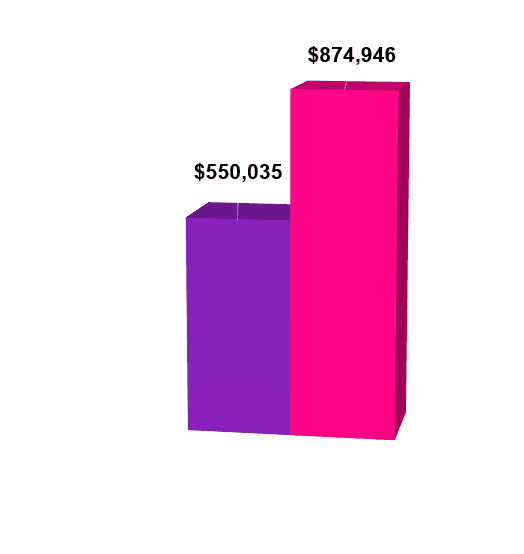

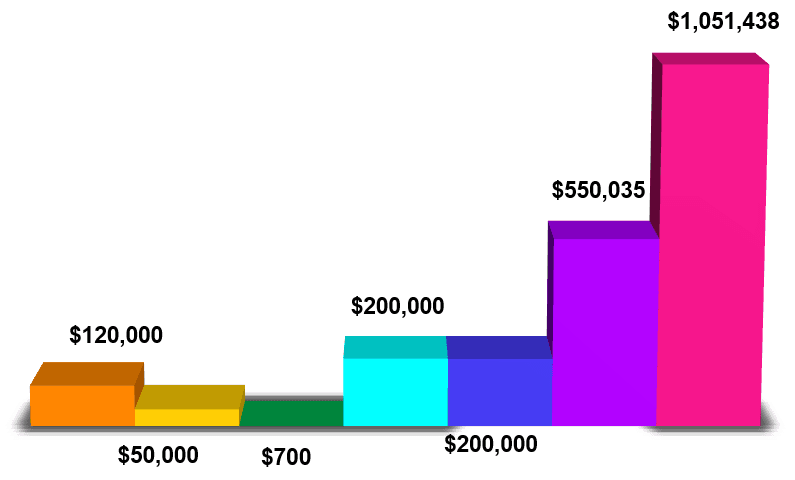

Based on all of the information gathered from the client (financials, investments, insurances, risk tolerance and goals) our specialized mortgage calculator creates a comparison of a traditional mortgage approval alongside an expected approval, using our reorganized asset blend.

Once a client decides to move forward, we will facilitate all steps necessary to bring the agreed-upon proposals to life. Asset transfers, investments reorganization, insurance implementation and all coordination with the client’s other professional advisors (CPA, attorney, realtor, etc) are managed, providing required documentation for underwriting.

For certain clients (or maybe just for fun), you may want to see what our program can really do. We have now made it possible for users to adjust the inputs themselves, controlling income and risk tolerance options on the calculator. We have also included Maximum Leverage slides for each client in their fully customized presentation, showing them what they could potentially qualify for should they want to reach for the stars.

Increase Real Estate Purchasing Power

Use our proprietary methods to evaluate, reorganize and manage client assets in ways that maximize mortgage approval and increase underwriting confidence.

Enhance Client Long-term Wealth Building

Examine investments, including real estate, and apply our program to the way clients purchase and hold these assets, increasing the chance for long-term wealth building.

Maximize Tax Benefits and Reduce Liabilities

Maintain deductions while allowing for the utilization of client assets without investment liquidation, encouraging continued growth while avoiding taxable events.

Protect Client Assets By Diversifying Risk

Utilize measured amounts of leverage, stable long-term financing and insurance to cover assets, allowing clients to grow net worth while protecting wealth.